Optical Communications Market Snapshot, Q2 2024

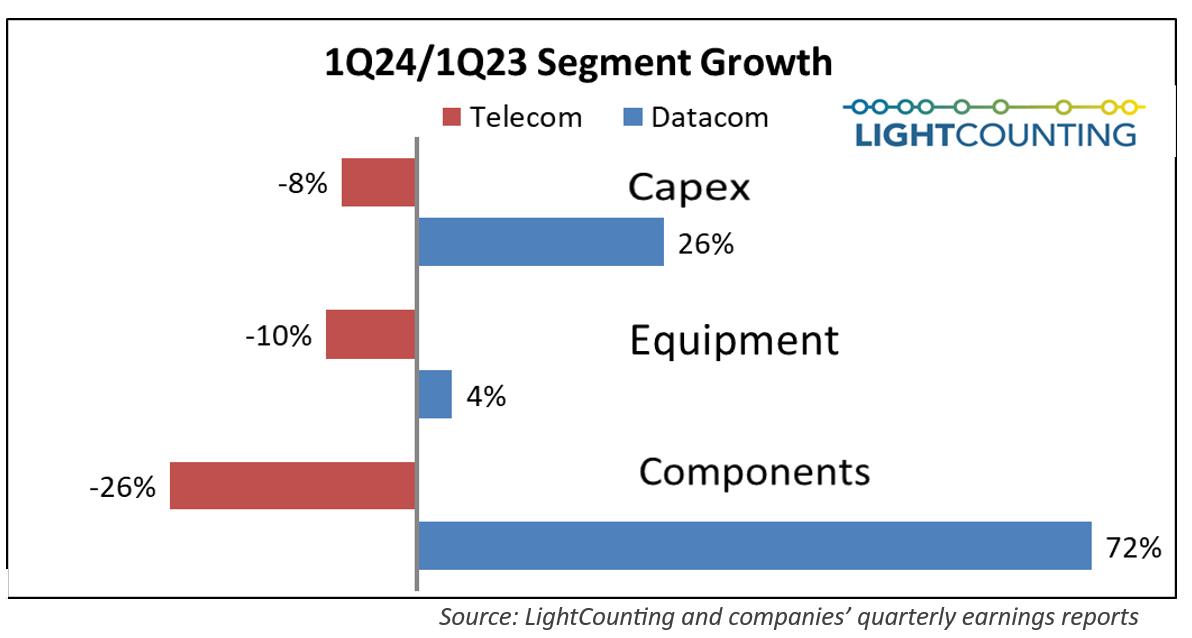

With the latest market report from LightCounting, we are able to get a glimpse of the dynamics of the optical communications market in the second quarter of 2024 (Q2 2024). In keeping with recent market performance, the optical communications market was once again starkly "hot and cold" this quarter: as has been the trend over the past several quarters, the optical communications market was markedly polarized in the first quarter of 2024 (Q1 2024). Telecom service provider (CSP) capex continues to be weak, while demand from hyperscale Internet companies (ICP Web content providers) is growing like a fire.

In the CSP space, total capex for the top 15 CSPs has declined year-on-year for six consecutive quarters, reflecting the continued lack of investment confidence in the telecom industry. In the ICP space, however, the situation is diametrically opposed. Spending by the top 15 ICPs grew for the second consecutive quarter, with two companies posting particularly strong growth rates of 91% and 66% respectively. Notably, ICP spending in China also showed significant growth, signaling that the AI boom is not only spreading globally, but is also profoundly impacting the Chinese market.

For equipment manufacturers, they may be experiencing a "roller coaster" experience. Sales of networking and optical transmission equipment fell 10% year-on-year, while server and switch makers saw their sales increase by only 4%. Even smaller, well-positioned second-tier vendors were not immune to this market volatility, with sales declining in unison.

However, there were some bright spots in a weak market. Sales of 400G and 800G Ethernet optical modules for AI cluster deployments were in line with market expectations, demonstrating the strong pull of AI demand for high-performance network connectivity. While demand for DWDM began to recover in the fourth quarter of 2023, the pace of recovery in the first quarter of 2024 was relatively slow. It is expected that demand for FTTx and WFH transceivers may struggle to recover over the next one to two years. Nonetheless, continued growth in cloud demand is expected to drive annual sales of Ethernet transceivers up 40% in 2024, which in turn will propel the overall transceiver market to a record high of over $260 million in the second quarter of 2024.

In the semiconductor segment, we saw an even starker contrast. The semiconductor sector grew 61% year-over-year, with this growth driven almost exclusively by headline companies (up 262%). This data once again highlights the vast difference between companies supporting ICP's AI ambitions and those supporting traditional communications providers, with booming data center sales suggesting that the impact of the AI arms race is spreading across the semiconductor industry.

Looking ahead, LightCounting Research expects spending on ICPs to continue to grow, which will open up more opportunities for better-positioned vendors. However, CSP spending is likely to remain subdued in the near term, which will undoubtedly be a challenge for large network equipment manufacturers. Who will be the ultimate winner in this race to the bottom in the optical communications market? Let's wait and see.

Source:https://www.lightcounting.com/login.

Categories

New Blog

Tags

© Copyright: 2025 ETU-Link Technology CO ., LTD All Rights Reserved.

IPv6 network supported

Friendly Links:

易天官网